Tesla surprised everyone on the financial markets on Monday, Feb. 8, when the report of Tesla buying $1.5 billion in BTC got public. Bitcoin’s price suddenly surged to its all-time high. Bitcoin’s market cap exceeded $800 billion for the first time.

According to Coinmarketcap.com, the price of Bitcoin reached $46,203 on Feb. 8, 2021. On Feb. 9 it went to its new all-time high of $47,899.

Tesla disclosed a $1.5 billion Bitcoin investment made in January 2021. An SEC filing revealed that Tesla made the Bitcoin investment in January as a part of their “alternative reserve assets” investment strategy.

Lately, Elon Musk, CEO of Tesla and SpaceX, got involved a lot with the crypto community. He changed his bio on Twitter to “#Bitcoin”, tweet about cryptocurrency (Bitcoin and Doge), and attend clubhouse discussion.

Every time Elon Musk tweets something about crypto, he moves the prices. Last time the price of bitcoin jumped +20%.

It is one of the most significant news that moves the cryptocurrency market.

Tesla became a new bitcoin corporate whale

David Lawant, a Bitwise researcher, points out that Tesla’s Bitcoin exposure represents roughly 7.7% of its gross cash position. Only one company, Microstrategy, has purchased more of the digital asset than Tesla.

According to the most recent 10K filing, @Tesla had cash & equivalents of $19.4 billion (gross), or $98 billion (net of debt and finance leases).

Using these figures as a reference, $1.5 billion in #Bitcoin represents an allocation of 7.7% on gross cash or 15.1% on net cash. https://t.co/FgRpzRcXBh pic.twitter.com/tDVqJGtj2Q

— David Lawant (@dlawant) February 8, 2021

Will Apple be the next?

We might see more companies buying bitcoin or other cryptocurrencies as a reserve asset. Dan Weiskopf, ETF professor, posted his opinion that the next big player might be Apple. He explains why Apple should take a bite out of Bitcoin as a hedge against inflation.

Tesla plans to accept bitcoin

Tesla plans to accept the digital asset as a mode of payment. Customers will have an option to buy a new Tesla car with bitcoin.

The received payments in bitcoin will not be liquidated for cash but added to Tesla’s balance sheet.

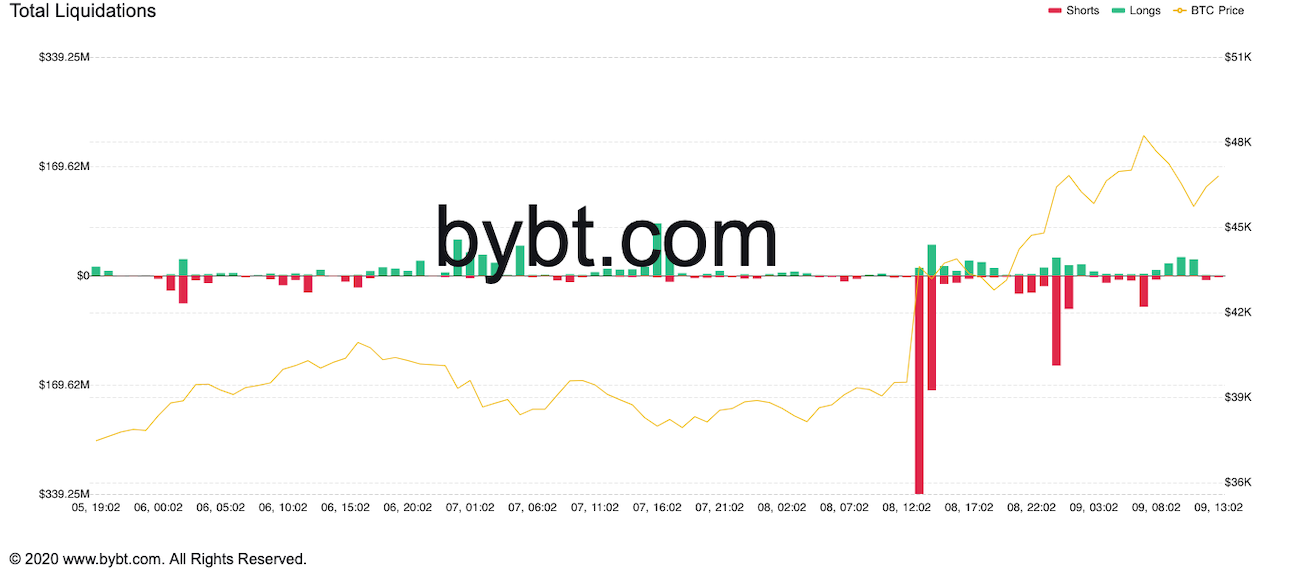

$500 million worth of Bitcoin was liquidated

According to the data from Bybt.com, more than $500 million worth of short positions to get liquidated as the price of bitcoin reached 45 thousand dollars.

Extremely high funding rates

Kraken, a leading crypto exchange in Europe, was struggling to deal with enormous traffic. Similar issues had also other major crypto exchanges. Kraken has temporarily stopped accepting new users due to extremely high demand.

The Binance exchange site went down for a while and Gemini and Coinbase also experienced technical issues as the price of Bitcoin reached its all-time high.

Breaking news: Tesla buys $1.5B in Bitcoin

Cointelegraph is discussing this epic event with professional trader Scott Melker, Bloomberg senior commodity strategist Mike McGlone, and Kraken growth lead Dan Held!

Bitcoin price

Data from TradingView showed Bitcoin got up by 18.5% and trading near $46,000. The majority of altcoins also surged to double-digit gains.

[ccpw id=”2027″]

Let’s have a look at the technical analysis chart.

[ccpw id=”1908″]