Australia’s financial sector is experiencing record disruption as emerging players enter the market and unsettle outdated business models with new technologies. Seamless event, the future of payment, was held in Sydney on the 13 and 14 of March 2018 in the brand new International Convention Centre located on the edge of the trendy Darling Harbour.

The entire payments eco-system was present. Banks, retailers and merchants came together to debate and assess alternative payment strategies and technologies that will be adopted in the new payments landscape.

Security concerns

In any industry but in finance especially, security is a priority and the cornerstone of robust and healthy information systems. Naturally, it was the center of many discussions.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment. The standard counts 250 controls that are continually evolving with technological progress. However, it is worth mentioning that being compliant to PCI DSS doesn’t mean being secure.

Losses as a result of fraud have increased during the past years due to insecure e-commerce websites, phishing and other scams according to William Belle from Rambus. To fight against it, his company encourages businesses to adopt payment tokenization which describes the process of replacing a primary account number with a unique payment token that is restricted in its usage. For example, a token will be generated to a specific device, merchant, transaction type or channel thus limiting the risk of getting payment information stolen or compromised.

Contactless payment solutions like Google Pay and Apple Pay are compliant with PCI DSS despite their differences in storing the payment information and utilizing tokenization.

Mobile Payment

Purchase habit discrepancies between Australasia and Asia have been observed in the past years.

Asian countries have skipped traditional credit card payments requiring an EFTPOS terminal. Instead, they send and receive payments with their lightweight and inexpensive smartphones and QR codes. China is the fastest growing market and trendsetter with AliPay and WeChat Pay that use the ubiquitous matrix barcodes.

In India, 56% of consumers are paying with a smartphone regularly with 51% in Thailand and 47% in Indonesia also utilizing this technology.

In New Zealand and Australia, the story is different as credit card services are largely adopted by the merchants and consumers. A recent trend has shown an increase in contactless payments through universal wallets such as Samsung Pay, Apple Pay and Google Pay.

The Australian payment system mainly targets the B2C market while in Asia, the use of QR codes and mobile payment targets both B2C and C2C markets. The Melbourne based start up, e-Pocket, understood the opportunity in the sector and launched an ICO in December 2017 to January 2018. The token EPT is based on the ERC20 standard and will be qualified as a currency, exchangeable with fiat money, according to their whitepaper.

The innovative company founded by Tapha Faye has developed a platform which enables users to make payments with stored bank/credit card, e-Pocket wallet, or cryptocurrency (Bitcoin, Bitcoin Cash and Ethereum) by scanning QR Codes as well as receiving payments via this method. The Android app and the web portal will be launched in April 2018. Finally, Tapha Faye unofficially announced their plan of creating a cryptocurrency exchange in the near future.

Cryptocurrencies Industry Oriented

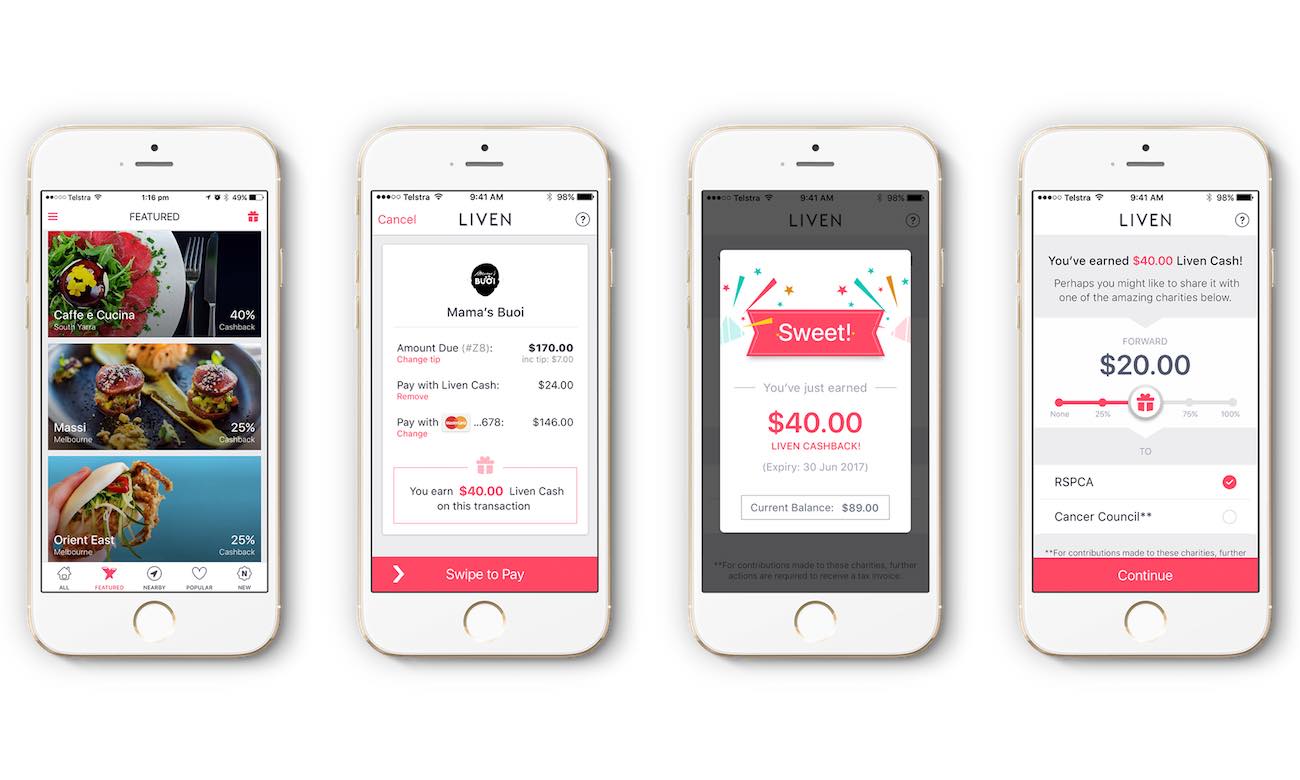

Liven’s Co-Founder Grace Wong stated that nowadays, the fiat currencies are defined within geographical borders and she anticipates that cryptocurrencies will eventually be organized by industry. The energy industry, the transport industry, the food industry and so on will have their own coins that will be traded and exchanged within their individual eco-systems.

Liven is positioned in the food market and has successfully partnered with 500+ restaurants across Sydney and Melbourne. Their iOS and Android app store a wallet which allows users to pay restaurants directly and earn Liven Cash in return. Liven Cash is a universal digital currency of dollar value rewards credit. It can be spent in any partner venue, saved up for a special occasion, or donated to your choice of charity.

Liven intends to move onto the blockchain and launch their food industry token named LVN by the end of March 2018.

The future of payment: Take & Go

At the tech hub, William Belle mentioned briefly the future of payment and the ultimate buying experience: “take & go”. The capabilities of all smart devices combined with the power of sensors, image recognition and deep learning technology, will make purchasing as easy as walking into the shop, taking your product of choice and walking out. No need for queuing or checking out. All will be automatically handled by machines, transforming consumer habits into a seamless experience.

For more information visit official website Seamless Australiasia.