Cryptocurrency is becoming the top news on all financial e-magazines and headlines about investing in bitcoin and adopting digital assets went viral. The price of Bitcoin reached an all-time high. The bullish trend is here to stay. Many experts predict a correction, but no one knows when it comes.

What becomes obvious is that the old traditional financial system started to publicly adopt cryptocurrencies, starting with Bitcoin and Ethereum. One of the big differences from the Bitcoin bubble in 2017 is that today institutions are buying or are ready to buy crypto. Digital assets are a more important part of the payments world nowadays and we finally have a good infrastructure and blockchain development to provide a safe and effective environment.

Let’s see what happened in the crypto space in week 6, from Feb. 8 to Feb 14. We review the performance of the largest cryptocurrencies, top gainers, the latest global news stories affecting the crypto market.

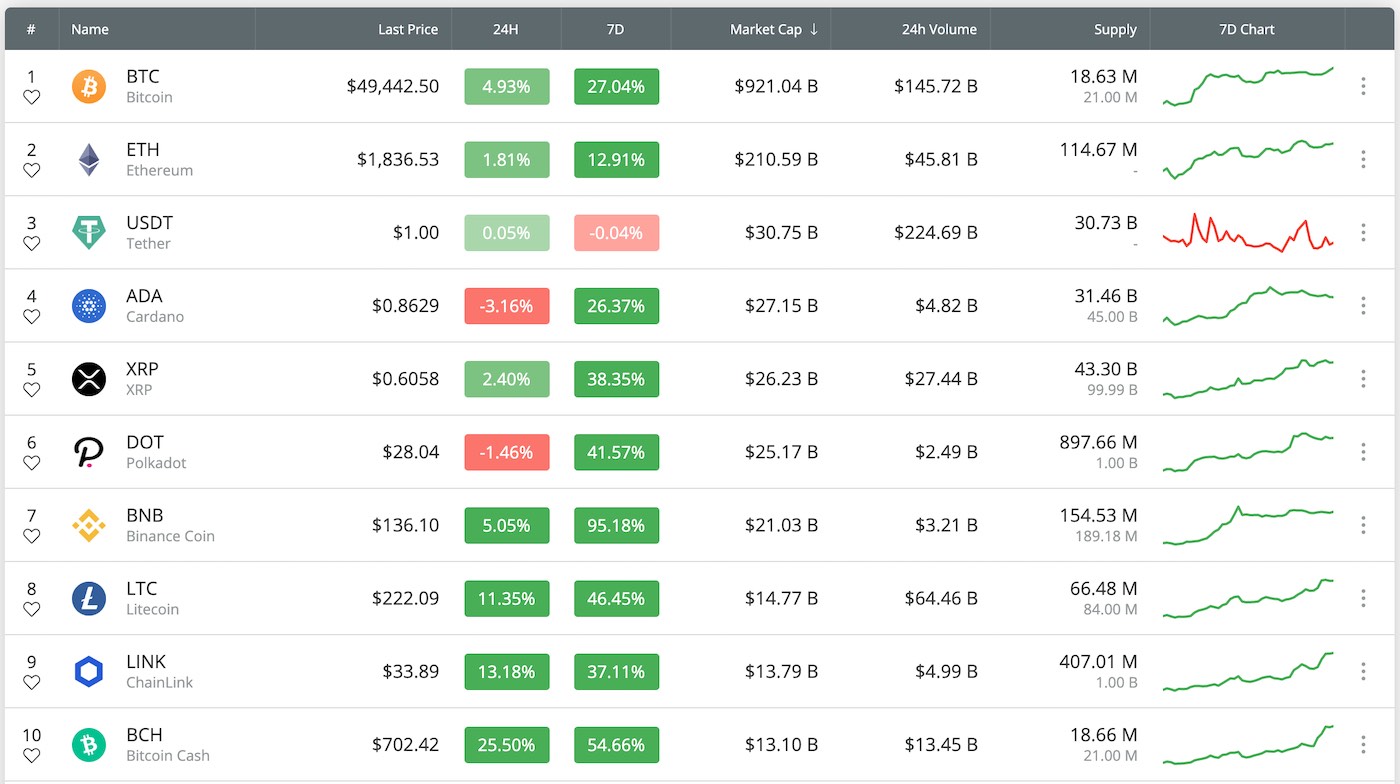

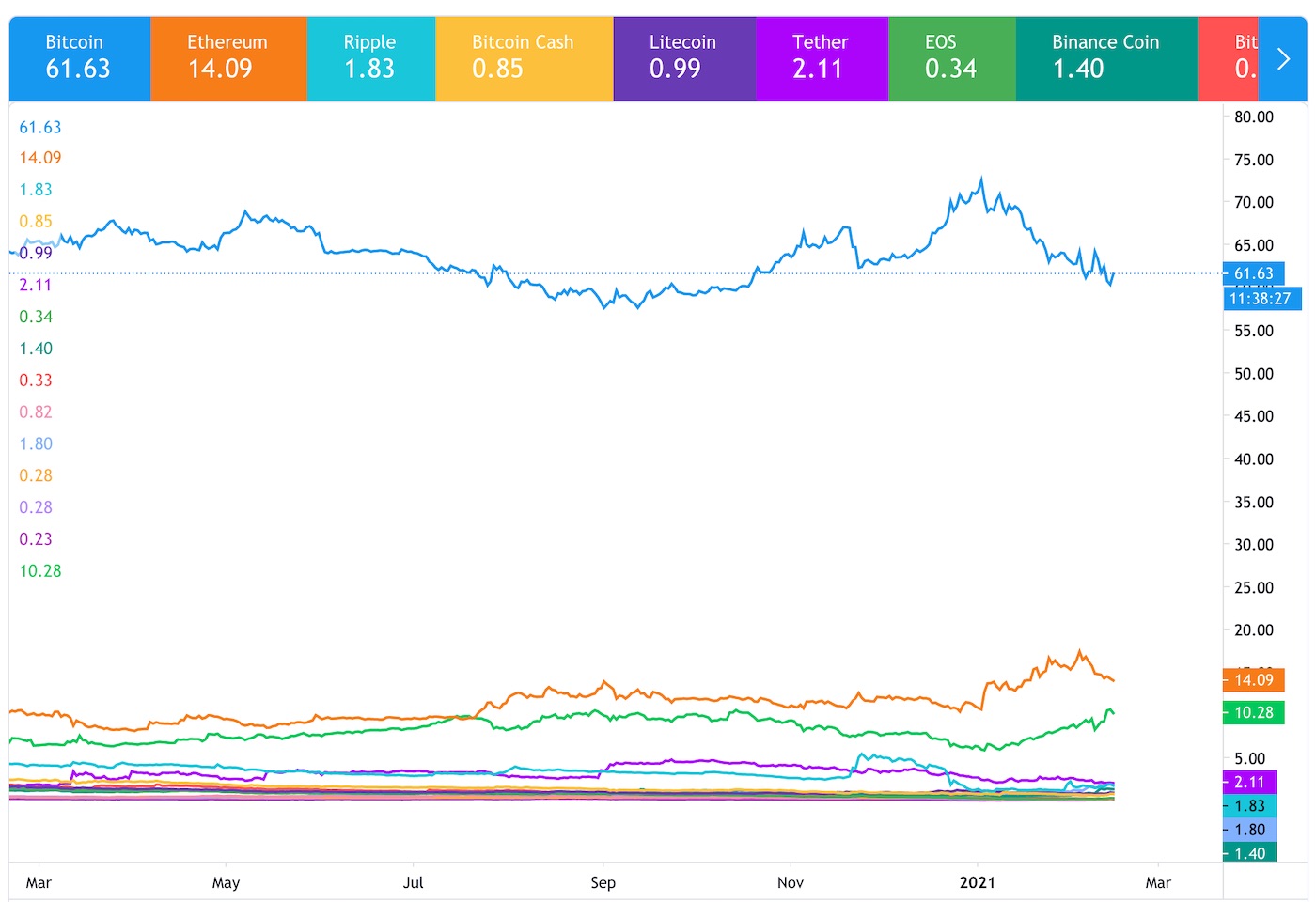

Cryptocurrency market and prices

The top 10 cryptocurrencies, according to Coincheckup.com on Feb. 14.

The Bitcoin price (BTC) resumed its rise this week and reached a new all-time high of over $49,000.

[ccpw id=”2027″]

The total crypto market capitalization almost touching the $1.5 trillion level.

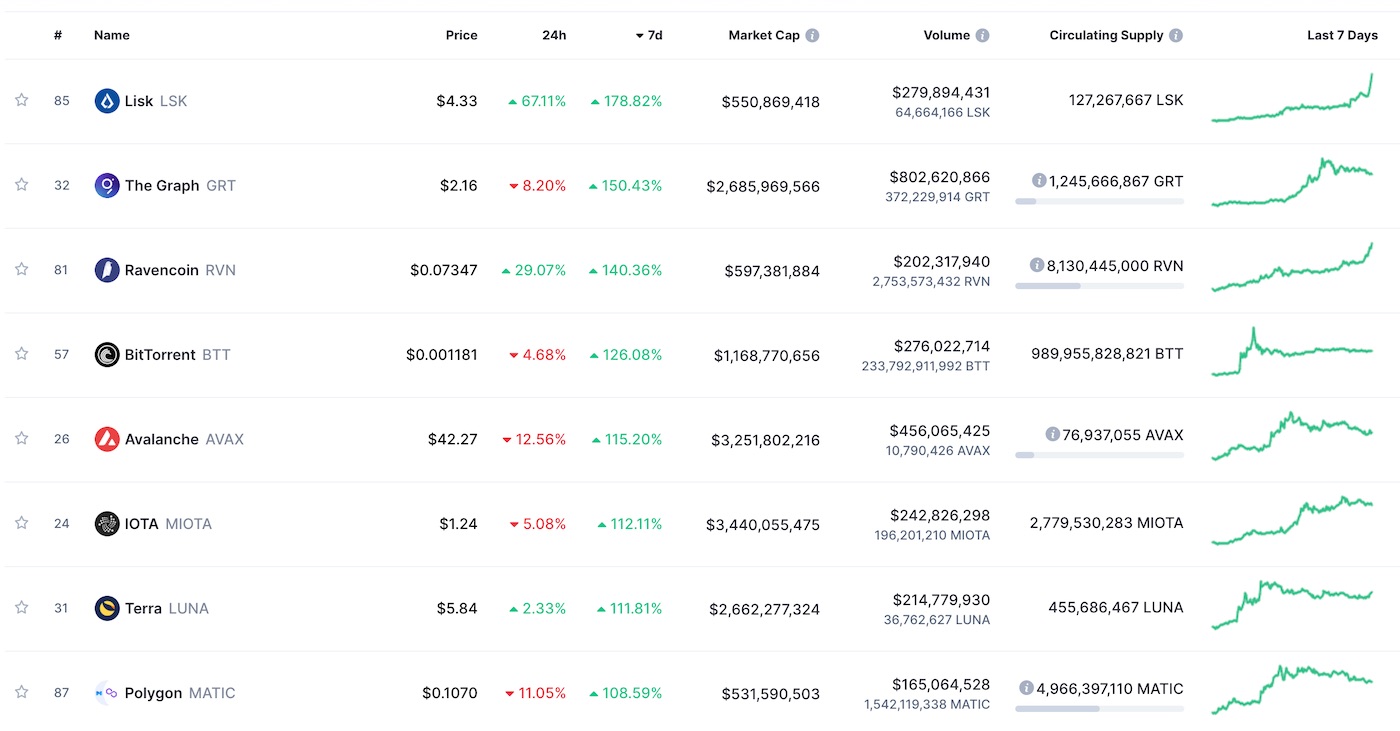

Top Gainers

The biggest 7-day return made investors with altcoins Lisk, The Graph, Ravencoin, BitTorrent, Avalanche, IOTA, Terra and Polygon.

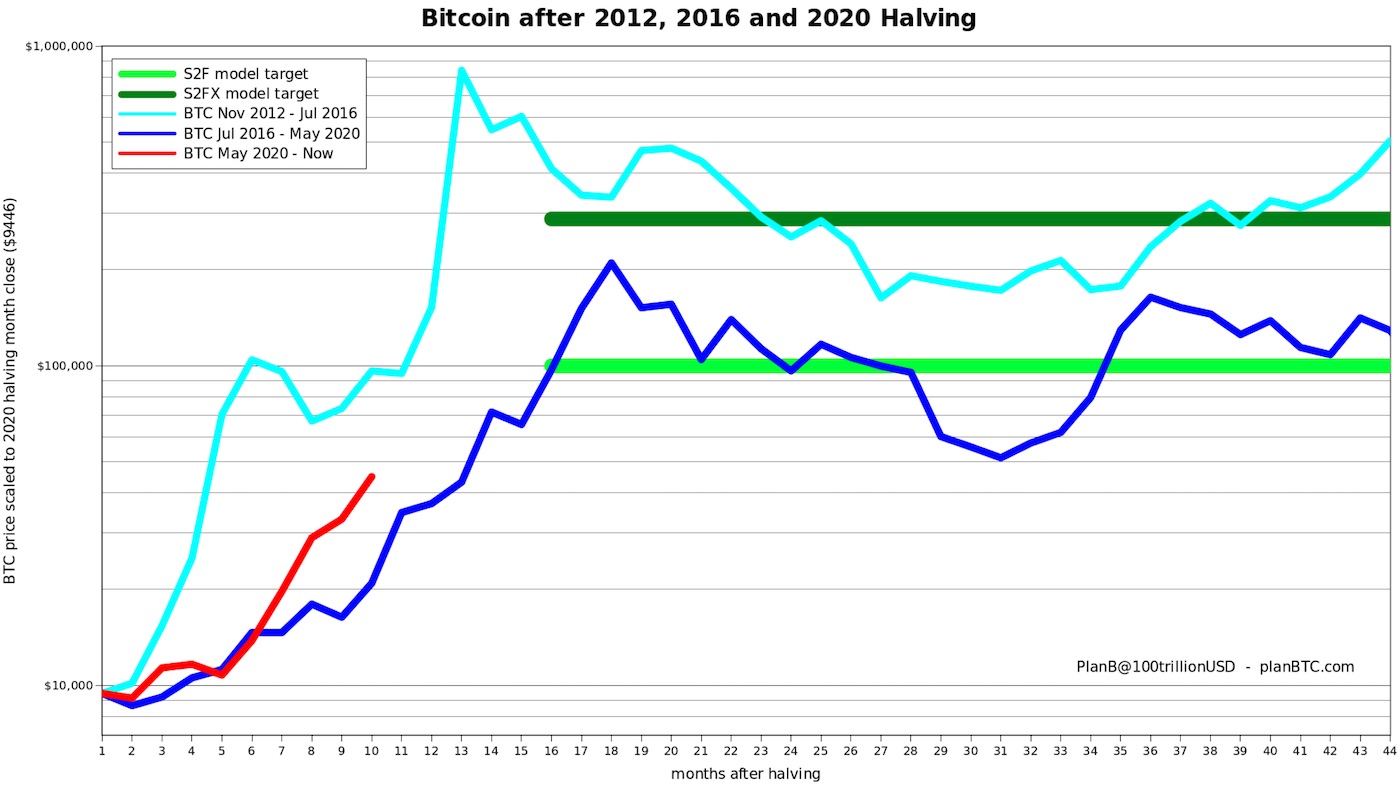

Bitcoin price prediction, stock-to-flow model

According to the creator of the stock-to-flow model, Bitcoin is on track for $100K between April and September 2021.

Plan B tweeted on Feb. 5:

“Bitcoin the price track after 2020 halving is between 2012 and 2016 tracks. I added S2F ($100K) and S2FX ($288K) model targets. Targets are average prices, actual BTC price will oscillate around targets. If 2021 bull market follows 2017 then $100K it is, if we follow 2013 .. $288K.”

Stock to flow model was introduced in March 2019. The hypothesis in the study is that scarcity directly drives value.

News and Insights

Nassim Taleb is getting rid of Bitcoin

Nassim Nicolas Taleb, the author of the bestseller book The Black Swann, changed his view on Bitcoin (Feb. 12).

“I’ve been getting rid of my BTC. Why? A currency is never supposed to be more volatile than what you buy & sell with it. You can’t price goods in BTC In that respect, it’s a failure (at least for now). It was taken over by Covid denying sociopaths w/the sophistication of amoebas”

He was a cryptocurrency evangelist with tweeting: Use cryptocurrencies (16 Apr. 2020). Many asks, what has changed in Taleb’s mind?

Bitcoin misfits share the monocellular brain & logical wiring defects: “BTC is a good idea therefore IT WILL BE *THE* reserve currency” (i.e. no other ideas & no other reserve).

Reserve ≄Volatile+ It is not supposed to be volatile AT HIGHER PRICES.

+ Never found uses. https://t.co/BoGLk9a4dq— Nassim Nicholas Taleb (@nntaleb) February 14, 2021

Jack Dorsey and Jay-Z gave 500 BTC on Bitcoin development

Jack Dorsey, CEO of Twitter and Square, has taken to Twitter to announce that he and American rapper Jay-Z (Shawn Corey Carter) have decided to give 500 Bitcoins to a new trust that will focus on Bitcoin development, initially focused on teams in Africa & India.

Chainlink

Chainlink aims to bring Decentralized Finance (DeFi) to the film industry. Mogul Film Financier Integrates with Chainlink Oracle to bring more efficiency and transparency to film production, such as effectively manage voting, investment, and rewards activities using blockchain technology.

Cardano

Cardano has over 100 commercial projects in the pipeline, says Hoskinson. Cardano surged by over 400% since the beginning of the year.

“I have a hundred plus commercial projects in the pipeline that want to either migrate or build something on Cardano”, said Hoskinson during the interview.

ADA approaching the $1 price mark, but note, that Cardano is still not listed on exchanges like Coinbase and Gemini. It is also not presently supported by PayPal.

IOTA, the Alvarium project

The IOTA Foundation and Dell Technologies have introduced a solution for measuring the trustworthiness of data (Feb. 9). The Alvarium project creates trust scores between IoT devices.

“The system logs different steps in the journey of each data point, as it travels from an edge or IoT device sensor, to a router, to an edge server, and to the cloud. Each interaction is given a trust rating, a score, according to industry-specific requirements. Importantly, these scores are logged on the IOTA Tangle to ensure integrity and prevent tampering.”

“For real-world scenarios, we need look no further than the global pandemic. It could massively reduce friction if there were a way to measure the trustworthiness of the data involved in the vaccine rollout. Everything from the provenance of which vaccines are coming from which manufacturer, to how many people in which regions are getting the vaccines, could be managed much more effectively if there were a trust certification measurement for all involved actors.”

Greyscale

According to Bybt.com, many sources reveal the $93 million purchase of Ethereum by Grayscale was in the form of 52,730 ETH in 24 hours (Feb. 12). It is the largest inflow since Grayscale reopened the ETH trust. Grayscale has accumulated 191,645 Ethereum worth $339.2 Million in the last 30 days.

Adoption

Tesla

Tesla bought 1.5B dollars worth of Bitcoin at the beginning of this week and became one of the few corporate whales. The news spiked the price of Bitcoin to almost 48 thousand dollars.

There are many rumors about who will be the next to buy Bitcoin as a reserve asset. Microstrategy set up this idea when it first bought 250 million dollars worth of Bitcoin in August 2020.

Charles Hoskinson, the co-founder of IOHK and cryptocurrency Cardano, shares the idea that Apple or Oracle might be the next companies buying Bitcoin after Tesla. Apple should take a bite out of Bitcoin as a hedge against inflation, said Dan Weiskopf, ETF Professor.

Mastercard

Mastercard announced that this year (2021) will start supporting select cryptocurrencies directly on their network. Mastercard teamed up with Wirex and BitPay last year to create crypto cards that allow people to transact using their cryptocurrencies.

Mastercard is also actively engaging with several major central banks around the world, as they review plans to launch new digital currencies, dubbed CBDCs.

This move is one of the biggest and visible crypto-move from a big traditional payment company. But Mastercard is already in the blockchain and crypto world for some time. They have up to 89 blockchain patents granted globally with an additional 285 blockchain applications pending worldwide.

PayPal

PayPal Holdings, Inc. (NASDAQ: PYPL) announced their move to crypto in August 2020. PayPal’s new service will allow (early 2021) its customers to buy, hold and sell cryptocurrency directly from their PayPal account. The impact of it will be enormous because it will also enable cryptocurrency as a funding source for digital commerce at its 26 million merchants. The company is expected to generate over $2 billion in revenue from Bitcoin alone by 2023

According to u.today, payment giant PayPal will continue to deliver its promise to integrate cryptocurrency. U.S customers were able to trade and hold digital assent since mid-November 2020. Now, the United Kingdom will follow in the coming months.

PayPal will allow its customers to shop with Bitcoin and other cryptocurrencies later this year (2021).

Apple

Apple Pay announces (Feb. 12) support for Bitcoin and crypto payments through BitPay, the world’s largest provider of Bitcoin and cryptocurrency payment services. US cardholders of the BitPay Prepaid Mastercard can add their card to Apple Wallet. Support for Google Pay and Samsung Pay is planned for later this quarter.

Apple Pay accounts for about 5% of global card transactions and is on pace to handle 1-in-10 such payments by 2025, according to recent trend data compiled by Bernstein, a research firm.

Uber

Uber CEO Dara Khosrowshahi, confirmed that Uber will accept bitcoin and other cryptocurrencies as payment. They won’t be investing in bitcoin as part of its treasury. In an interview with CNBC said:

“Just like we accept all kinds of local currency we are going to look at cryptocurrency and or #bitcoin in terms of currency to transact. That’s good for business, that’s good for our riders and our eaters,…We are just not going to do it as part of a promotion.”

Uber has been a member of the Libra (now Diem, the cryptocurrency founded by Facebook) Association since October 2019.

Bank of New York Mellon

According to CNBC (Feb. 11), Bank of New York Mellon (NYSE: BK), the oldest bank of the United States, has announced that it will start financing bitcoin and other digital currencies. It will provide a cryptocurrency custody service.

“BNY Mellon is proud to be the first global bank to announce plans to provide an integrated service for digital assets,” said Roman Regelman, head of digital at BNY Mellon.

Shares of BNY Mellon rose 2% in premarket trading following the news.

Blue Ridge Bank

Blue Ridge Bank is the first commercial bank to allow its customers to buy and sell Bitcoin at its 19 ATM locations.

“For years, consumers have been asking for the ability to buy bitcoin from their banks. We are proud that BRB is the first bank in the nation to offer bitcoin services on their ATMs.” – Chris Yim, Co-Founder & CEO of LibertyX, Bitcoin ATM software provider, dailyhodl

Miami, the first Bitcoin municipal in US

Miami’s City Commission has successfully passed a resolution proposed by Mayor Francis Suarez that allows municipal employees to get paid in Bitcoin.

“It’s wonderful to be a very crypto-forward city in the city of Miami and I want to thank my commission colleagues for allowing that to happen. ” – Suarez, u-today

Miami could also put its treasury reserves into Bitcoin in the future, according to Suarez.

Deutsche Bank, Germany

Deutsche Bank, the world’s 21st largest bank, aims to develop a fully integrated custody platform for institutional clients. According to the World Economic forum report (page 23-24), the bank has completed its proof of concept and is aiming for a minimum viable product in 2021 while exploring global client interest for a pilot initiative.

Regulation

First Bitcoin ETF approved in Canada

Ontario Securities Commission gave the green light (Feb. 11) for the institutional product. Calgary-based financial services firm Accelerate Financial Technologies managed to fulfill all requirements to list its Bitcoin ETF on the Toronto Stock Exchange.

Julian Klymochko, Founder and CEO of Accelerate, said:

“Bitcoin has been one of the best performing asset classes on a 1-year, 3-year, 5-year and 10-year basis, both absolute and risk-adjusted. Given Bitcoin’s historical track record and future potential, along with its portfolio diversification properties, we are looking forward to offering investors exposure to the asset class in an easy-to-use, low-cost ETF.”

ABTC will offer U.S. dollar-denominated units and Canadian dollar-denominated units, with a management fee of 0.70%. Accelerate has applied to list units of ABTC on the Toronto Stock Exchange (“TSX”)

India

The Indian government is also considering a complete ban on cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others. They plan to create its own Central Bank Digital Currency (CBDC). It appears that they don’t do it to improve their financial system for people but to strengthen their centralized financial system. Within their CBDC blockchain infrastructure, every wallet holder will be identified, and every transaction will be tracked and monitored by the Central Bank. A similar solution is implemented in China.

The bill will prohibit all cryptocurrencies, except CBDCs. If passed, Indian crypto investors will get three to six months to exit their holdings.

Nigeria

The Central Bank of Nigeria (CBN) ordered banks and other financial institutions to “Identify persons and/or entities transacting in or operating cryptocurrency exchanges (…) and ensure that such accounts are closed immediately…” Nigeria might still be a very interesting market for any cryptocurrency if they choose to go decentralized peer-to-peer way. According to Statista, the number of smartphone users in Nigeria, Africa’s biggest economy and most populous country, is forecast to grow to more than 140 million by 2025, tripling in the next five to six years. There is one more surprising fact, there are more internet users in Nigeria than in Japan.

Upcoming week in crypto

[ccpw id=”1908″]

Let’s see what brings the upcoming week for us.

Stay focused, stay disciplined. Play the long game. There’s always a coin that’s pumping harder than the one you own. Don’t be greedy. Enjoy the process of exploring the crypto space. If you’re already in, you are in the right space. Tune your activity, don’t overthink it, don’t gamble. Stay in crypto space to enjoy the ride.